Turn expenses hell into accounting heaven.

Empowering your clients with Pleo's smart company cards means less paperwork, less back and forth, less end-of-month stress.

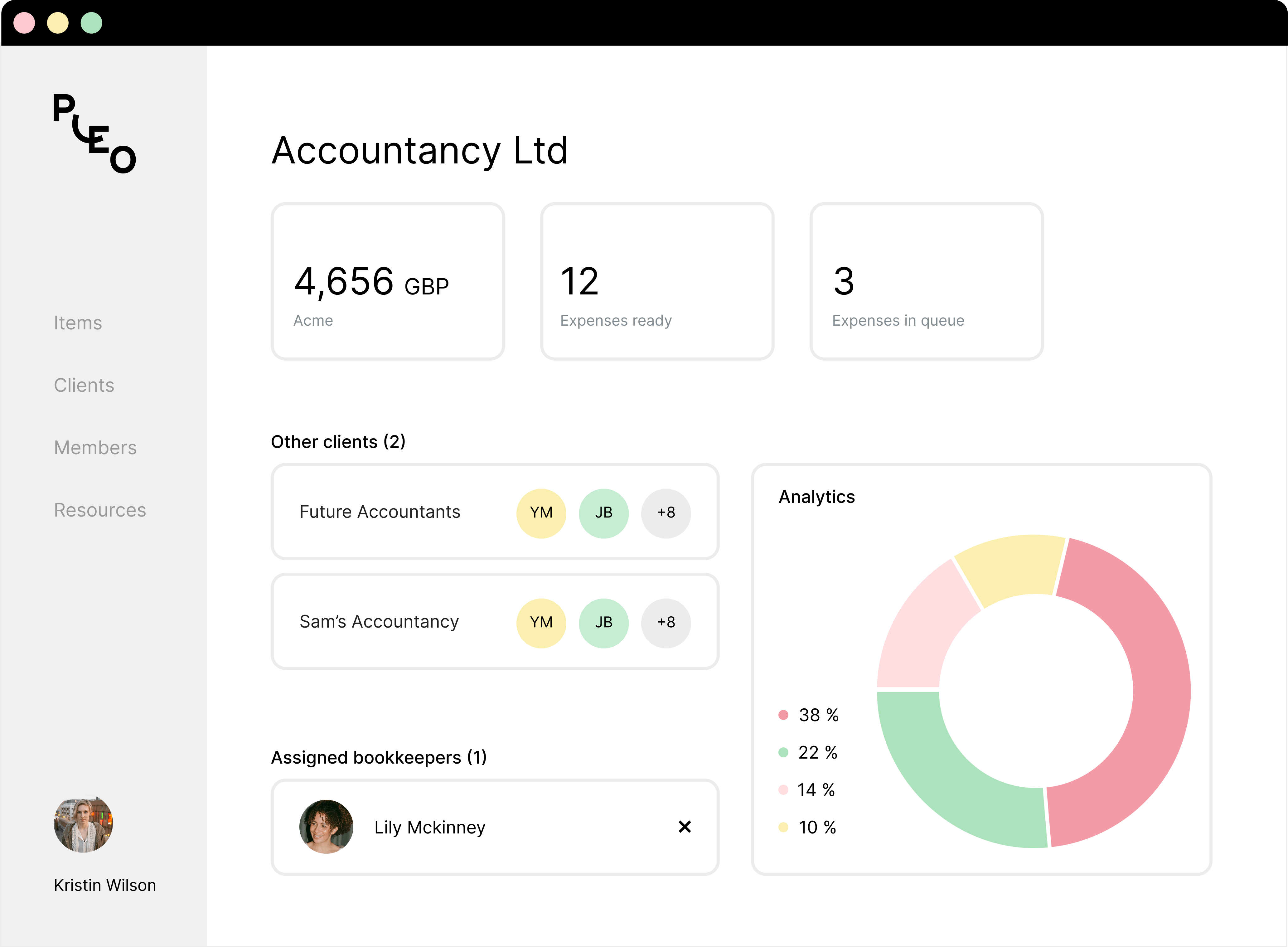

Explore our Partner Portal

Everything you need, in one place

With Pleo’s Partner Portal, you can onboard and manage your clients and their expenses in one handy hub.

You're in good company. We also partner with:

Why partner with Pleo?

The very best for your clients

Your clients' security means everything to us. We're partnered with MasterCard, JP Morgan and Danske Bank - and are ranked the #1 spend solution in Europe.

Save time (and money)

No more chasing clients for receipts. Automate your accounting and make reconciliation refreshingly easy.

Designed for you

Our Partner Portal enables easy onboarding and client management - as well as exclusive benefits available under our Partner Programme.

How it works

Business spending, transformed

Pleo’s company cards give your clients full visibility over all their spend - automating everything from expenses and mileage to invoices and AP.

No more lost receipts

Help your clients stay compliant with receipts attached to every expense. Scan them on-the-go from the Pleo app.

Real-time overview

Give clients instant insights into how and where their money is being spent, enabling better budgeting and cashflow control.

End-of-month made easy

When you’re ready, just export your clients’ data from Pleo to the accounting system for automatic reconciliation.

Everything you need, in one place

With Pleo’s Partner Portal, you can onboard and manage your clients in one handy hub.

What's not to love?

Here are a few features your customers will love

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C1300%2C800&w=1300&h=800)

Invoices

Give your clients the full picture on all their spend with Pleo invoices, our one-stop-shop to process, approve and pay supplier invoices directly from the Pleo Wallet.

Direct Reimbursements

Forget manual reimbursements through payroll or bank transfer. With Pleo, the employee can reimburse themselves as soon as the transaction has been approved.

Accounting integrations

Pleo links up beautifully with the accounting tools you use every day. Export everything from Pleo to your accounting system for automatic reconciliation.

Mileage

Pleo makes it easy for clients to log their journey from A to B – including point-to-point calculations, mileage thresholds and advisory fuel rates.

How Scaleup Finance is redefining financial management with Pleo

"Pleo is a great technology that we find works incredibly well with our workflow. It compliments our ethos." - Andy Stulga, Finance Director

Pleo Partner Programme

| New Partner* | Bronze | Silver | Gold | Platinum | |

|---|---|---|---|---|---|

| Number of paid users per year | 0-9 | 10-39 | 40-99 | 100+ | |

| Number of clients per year | 5+ | 10+ |

*First six months

| Enhance your business | New Partner | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|---|

| Discounted Pleo for your practice | Free for 6 months | No discount | 50% discount | 50% discount | 50% discount |

| Client discount (valid 1 year) | 30% | No discount | 10% | 20% | 30% |

| Listing on Pleo Partner directory | |||||

| Revenue share | 10% | 20% |

| Marketing | New Partner | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|---|

| Marketing support | |||||

| Co-marketing funds | |||||

| Access to exclusive VIP events |

| Support | New Partner | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|---|

| Chat support | |||||

| Email support | |||||

| Video call support | |||||

| Dedicated Partner Manager |

"I would recommend Pleo to every company that wants to save time. Pleo has enabled us to gain happy clients, which in turn helps them refer other companies to join our practice."

Ben Withinshaw Director of Surrey Hills Accountancy Limited

Partner with Pleo

Ready to enhance your offering? Talk to someone from our partnerships team today & start using Pleo.

Powered in the UK by B4B partnership