Stop spending time on expenses

Do more of the work that matters. Centralize your business spending for complete financial efficiency and balance the books effortlessly with Pleo.

All of your expenses, covered

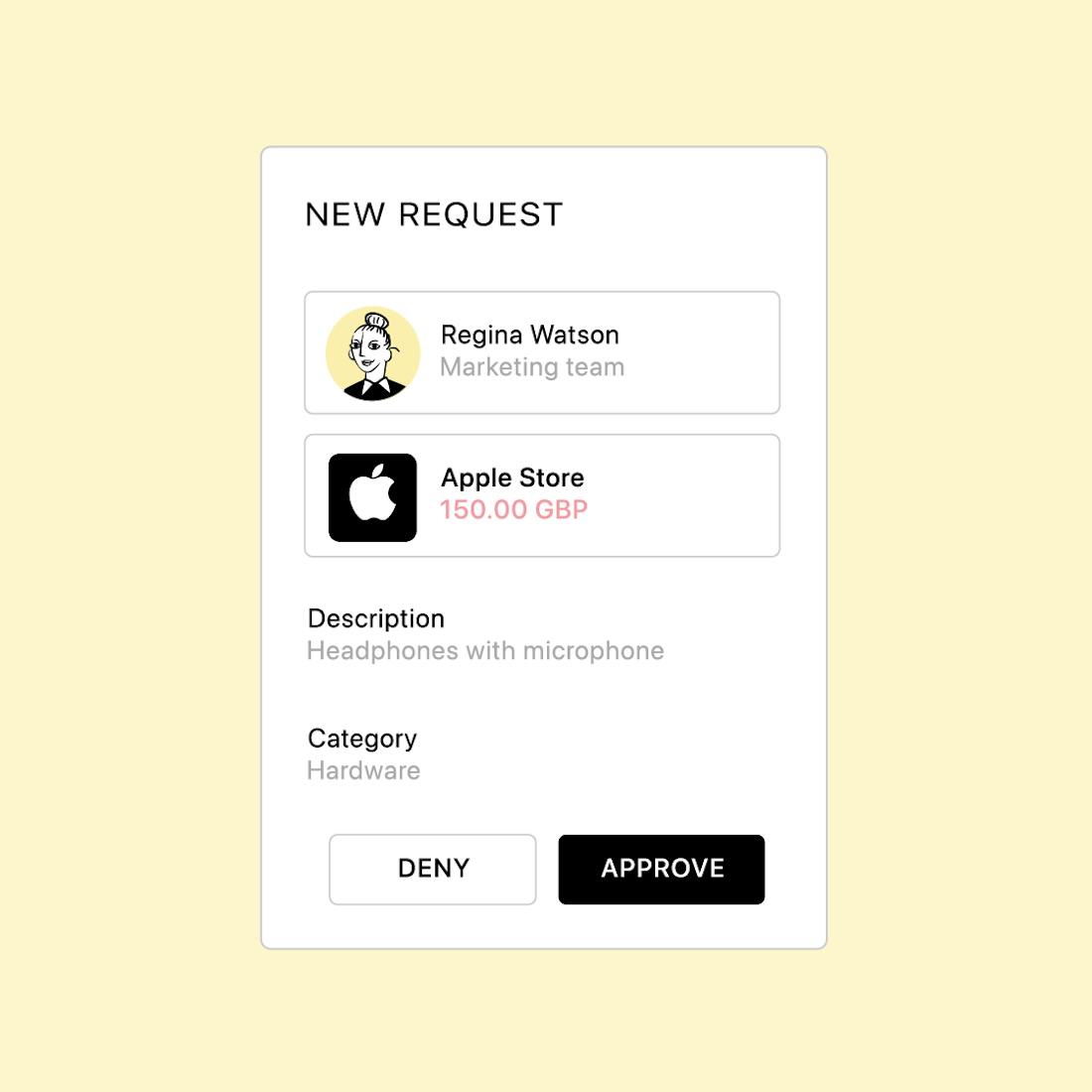

Issue Pleo’s smart company cards with individual spending limits. Your team can buy what they need, while we sort the paperwork automatically.

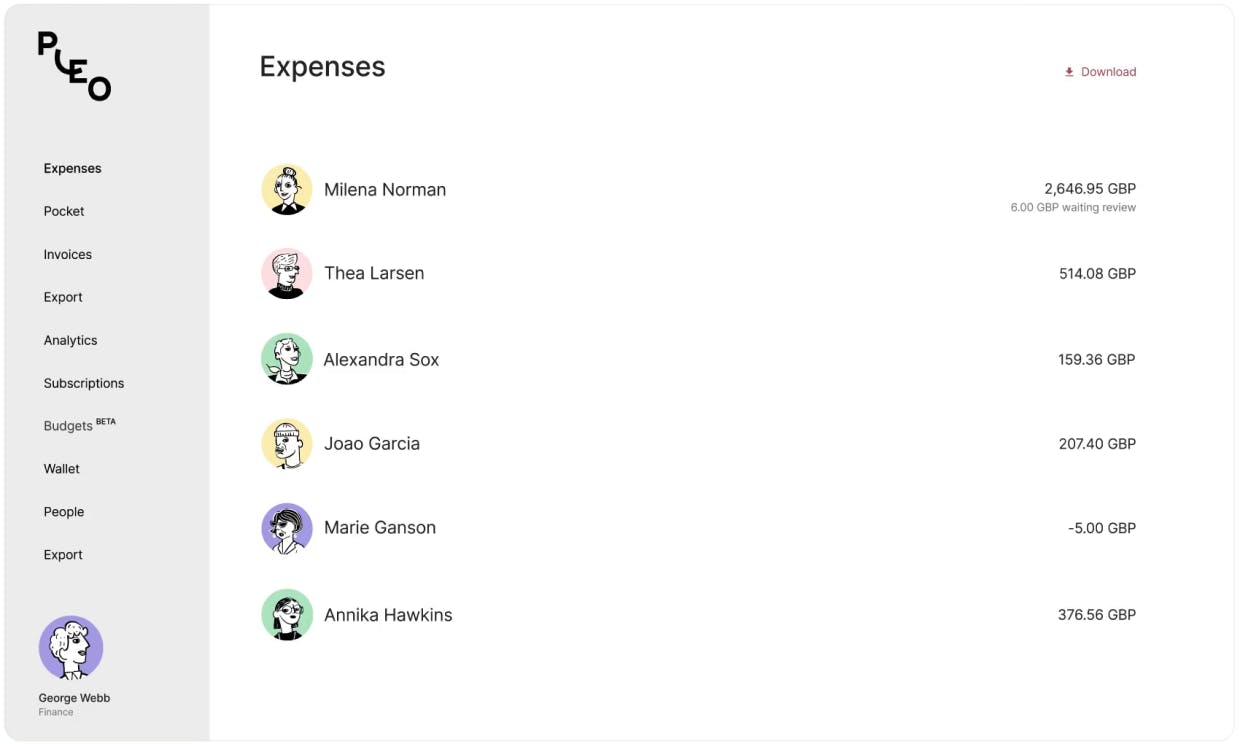

Real-time overview

Admins get the details they need on every purchase. Something doesn’t look right? Just tap a button to flag it or if you need, freeze your business expense card.